What are the 2023 key healthcare trends in Southeast Asia?

The state of healthcare as it faces macroeconomic woes.

In 2022, Southeast Asian hospitals implemented frugal initiatives to beat the inflationary pressures by establishing single-specialty hospitals and ambulatory centres. Amongst the hospitals that adopted these healthcare infrastructures are Tan Tock Seng Hospital in Singapore and ALTY Hospital in Malaysia.

Now, after two years into the post-pandemic era, how will hospitals in the region perform in the continued digitisation journey and other cost-effective attempts to improve patient care?

Thought leaders shared their projections with Healthcare Asia.

Anurag Agrawal, partner and associate director of healthcare at Boston Consulting Group

Alan Ong, principal at Boston Consulting Group

Southeast Asia is a highly heterogeneous region with wide variation in healthcare markets. However, across the board, we see four important trends that will have a major impact in 2023.

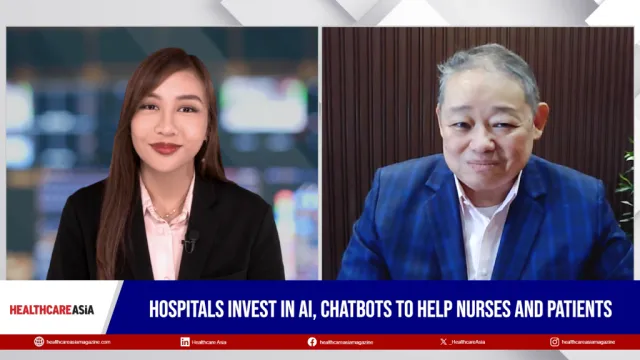

First, digital health will continue to be a major focus for all healthcare players. COVID-19 has greatly accelerated digital adoption in the delivery of health services. Video consultation, chat interactions between doctors and patients, remote monitoring, online access to health results, and AI chatbots for triaging, are now widely available and are becoming baked into consumer expectations. Healthcare players, including medical groups, hospitals, and diagnostic chains all now recognise digital patient engagement as core to their business.

Success will require going to market with a differentiated and focused value proposition, delivered through a high-quality digital product, and with a clear linkage to revenue.

Second, we see ongoing efforts in multiple markets to build the primary care sector to try and make healthcare services more cost-effective and accessible. Governments increasingly recognise that effective primary care is crucial for the health system to function in an efficient manner. The pandemic has also increased public awareness of the importance of primary care providers as the first line in the healthcare system. For instance, Singapore recently announced a Healthier SG plan under which residents will be encouraged to enrol with primary care practices for better continuity of care and to improve prevention efforts. In Indonesia, the Health Minister has spoken of primary care as being one of six key pillars for Indonesia’s healthcare reform.

Third, we also expect to see growing use of home care or home services. The pandemic has shown that a considerable proportion of healthcare services can be effectively delivered at home. This can be as simple as the home provision of phlebotomy for lab tests, or as complex as the provision of comprehensive home care for end-of-life patients. Patient preference and technological advances, supported by investor interest, will drive continued expansion of this space.

Finally, we expect that healthcare financing will become increasingly tight. The deteriorating economic outlook means that governments and private citizens will face increasing difficulty in financing health expenditures. At the same time, healthcare costs are expected to continue to increase. Given this, there will be increasing pressure to revise financing frameworks to put them on a more sustainable basis, ensure that payments are effective at driving healthcare value and improve operational efficiency and effectiveness. For instance, PhilHealth, which is the main vehicle for public health insurance in the Philippines, is in transition to the diagnosis-related group (DRG)-based reimbursement which will better reflect case complexity, improve their ability to monitor the quality of care, and improve PhilHealth’s financial sustainability.

Alex Boulton

Partner

Bain & Company

Southeast Asian healthcare has become an exciting incubator for innovation as long-term secular forces were catalysed through the pandemic.

Whilst admittedly a diverse collection of markets, most are burdened by rising demand from ageing and more affluent populations that overwhelm a constrained supply of medical professionals and infrastructure.

Pre-pandemic, it should be noted, private and public stakeholders are already making positive steps towards embracing structural reform and technology as essential solutions to the region’s healthcare access challenges. For example, both Indonesia and the Philippines underwent significant universal healthcare coverage reform in the five years preceding the pandemic, and the leading regional telehealth providers were founded in 2015 and 2016.

The pandemic was a crucible for stakeholders in the Southeast Asian healthcare markets. Notoriously traditional and slow-moving provider systems experienced extreme stress and were forced to ‘rethink’ the way care was and should be provided. After almost three years of fire-fighting and bootstrap innovation, we should hope and expect 2023 to be a year of proactive innovation.

There are several exciting opportunities for innovation in this region.

Rising consumerism in healthcare. Consumers are willing to prioritise and spend more on their healthcare. 50% of surveyed consumers in the region indicated a willingness to increase out-of-pocket spending over the next few years. Consumers desire more information about their healthcare and options and are more eager to spend on prevention and wellness.

A realignment of stakeholder trust. The notion of hospitals as de facto healthcare providers is slowly fading away. The industry is rapidly moving toward delivery models that are more convenient for consumers and less expensive to deliver, and care is moving outside hospital walls. Technology is helping healthcare organisations deliver high-touch services without the time or expense of physical interactions.

Increased desire for simplicity and convenience. More than 90% of surveyed consumers in Southeast Asia wanted a simpler system of care—a single touchpoint to manage all their healthcare needs. That need is being fulfilled differently across the Southeast Asia region. Digitally native companies are racing into markets like Indonesia, where primary care is limited, emboldened by the fact that one-third of survey respondents prefer that the ‘single touchpoint’ be virtual (an app or a hotline). Digital healthcare isn’t replacing established systems; rather, it’s enabling more connected, hybrid experiences.

Integrated offline-to-online models have the potential to deliver better patient experiences whilst optimising cost and efficiencies for care providers.

Telehealth adoption increased dramatically through the pandemic and recent data on active users from the region’s top digital health apps supports the assertion that telehealth is here to stay. Consumers are using telehealth to manage ongoing and chronic care, access acute and emergent care, and seek second opinions. Hospitals that stood up telemedicine capabilities through the pandemic are, across the region, doubling down on their technology investments; both internal systems and patient-facing applications.

With each of these opportunities and an appetite for bold investment in Southeast Asia’s healthcare, we expect to see meaningful innovation in 2023 and beyond.

Simplifying the patient's journey. Healthcare companies have the opportunity to consolidate multiple sources of data (e.g., patient profiles, behaviour, clinical data, medical bills and claims) and create a single touchpoint for patients. Centralisation will increase transparency and enable more personalised and cost-effective care. A simpler pathway to care can increase population health overall. Digital delivery models have a distinct advantage over physical locations and providers and can help erase healthcare disparity.

For example, access to healthcare is uneven across Indonesia. Metropolitan regions have almost five times the number of physicians as remote areas. Within cities, patients are often deterred by traffic and long waiting times. Halodoc, a health-tech platform, entered the market, pulling multiple healthcare service lines under one digital umbrella. Patients can manage appointments, prescription delivery, lab testing, consultations, and other services through a single point of contact. Halodoc estimates its virtual consultations are 70% to 80% cheaper for patients than seeing a provider in person.

Creating integrated continuums of care. Healthcare companies can develop seamless exchanges both between their online and offline delivery models and along the care continuum.

As telehealth develops, it can also guide patients—steering or triaging them—toward the right delivery model. During the pandemic, Raffles Medical Group in Singapore added mobile and remote services to improve healthcare access. A search-and-scheduling app empowered consumers to find COVID-19 tests, providers, and specialists, which helped to reduce wait times for in-person care. Raffles is integrating health insurance into its platform soon, coming full circle for patients on a single platform.

Delivering value-based care. As consumers become more involved in their care—and more willing to pay for it—this will challenge the traditional fee-for-service model. Healthcare companies need to deliver better customer experiences and outcomes—i.e., more value—to attract and retain lifelong patients. There are many untapped opportunities to increase value for patients before, during, and aftercare. As more health companies move toward value-based care over fee-for-service models, expect more emphasis on preventative health, convenience, and customer service. Health insurance in Southeast Asia will need to transform to provide access and coverage to the hundreds of millions of populations that are uninsured today but could afford to pay for some new form of health insurance.

Empowering patients and physicians with data and technology. More than 70% of consumers say they conduct research online to understand their symptoms and treatments, and more than 60% use technology to monitor their health. Consumers want access to their health information and want easy access to their primary physician for ongoing and chronic care. Health systems have to staff and support virtual-care providers to match demand and connect patients to the right care teams. Physicians too need the right technology, data and digital tools to deliver secure, quality services through virtual platforms and to work more efficiently.

The public health crisis forced healthcare companies to accelerate innovation plans and deliver care in new, patient-centric ways. Patients have always been important. That did not—and will not—change. But now, healthcare companies understand what’s important to patients. 2023 will undoubtedly be an exciting year for healthcare in Southeast Asia as this traditional sector flexes its newly acquired innovation muscle to address long-standing access challenges.

Advertise

Advertise