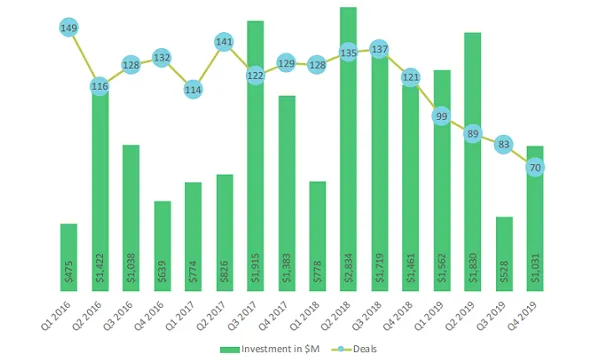

Asia Pacific healthtech funding crashed 27% to $4.95b in 2019

Healthtech investments in H2 slowed significantly.

The healthtech sector in the Asia Pacific (APAC) region has received about $4.95b of funding from around 340 transactions in 2019, according to a Galen Growth report. This figure is 27% YoY lower compared to 2018, but is 1% higher than in 2017.

The decline was dragged by the 25% crash in transactions during H2 2019, compared to 188 deals in H1. But despite the decline in deal volume and value, 2019’s average deal size was $14.6m. This shows a 12% increase YoY and 51% surge from 2017.

It also saw 13 mega deals, accounting for 38% of total funding. The 18 exits in 2019 (IPOs & M&As) accounted for 5.3% of the total funding, up 28% from 2018.

On a QoQ basis, healthtech funding deal value reversed its Q3 plunge of $528m to $1.03b in Q4 from 70 deals. However, Galen Growth noted that this is the 5th consecutive decline in deal volume closed in APAC as it was 43% lower than in Q4 2018.

Despite this downward trend, the average deal size in Q4 2019 was $19.9M, up 25% YoY, whilst the cumulative deal value since 2016 exceeded $20.2b.

For funding by stage, total early stage deal volume in 2019 dipped 65% YoY to $70m and accounting for 47% of the total funding value. Growth stage deals captured 66% of total funding, up 22% YoY by value share but dipped 12% YoY in deal value.

Total volume and value of series A deals fell 47% and 18% YoY, respectively, whilst series B deals closed at $1.63b, higher than in 2018 and claimed 33% of all deals. Lastly, late stage deal value share remains unchanged at 20%.

Currently, 48% of all healtech startups in APAC are at an early stage and almost a quarter (24%) of healthtech startups are at series A funding stage. The number of startups at the series B and C funding inched up 1% YoY, whilst startups in mega rounds plunged 52% YoY from 2018.

China remains the biggest receiver of healthtech funding, snapping up 33% ($3.47b) of the total deal value. This is followed by India at 19% ($723m) and South Korea at 17% ($241m). Startups under the medical diagnostics segment is still the top category as it saw 60 deals, outpacing health management solutions at 43 deals and patient solutions at 39 deals.

The most active investors in the healthtech space is China’s tech giant Tencent and venture capital firm Sequoia, participating in nine funding rounds each.

Advertise

Advertise