Thailand hospitals bank on growing capacities and scheme-backed patients

Bangkok Dusit Medical Services added two new hospitals in H1.

Thailand’s healthcare sector is expected to improve in profits starting Q3 after three quarters of decline as it utilizes additional capacity and high seasonal impact, according to UOB Kay Hian.

In particular, Bangkok Dusit Medical Services (BDMS) added two new hospitals in H1 2019. Bangkok Chain Hospital (BCH), Chularat Hospital (CHG) and Vibhavadi Medical Center (VIBHA) will also stand to benefit from rise in capacity and government-sponsored social security scheme (SC) patients.

However, Bumrungrad Hospital (BH) expects flat YoY sales from offering discount packages to patients.

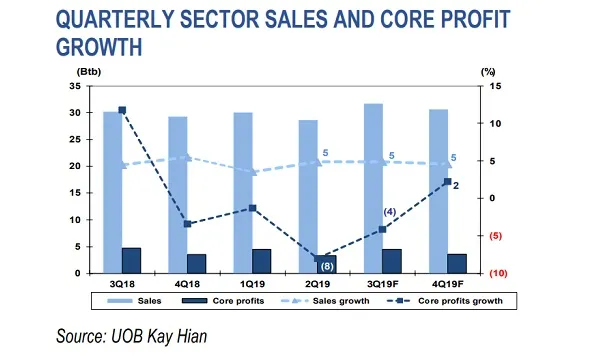

The sector’s core profit began to decline 3% YoY in Q4 2018 due to high costs of expansion and decline in patient volumes. The drop continued into the first half of 2019, but it is expected to bottom out by Q2 when it fell 8%. BH saw the steepest fall as it aggressively offered discount packages to patients.

In addition, BDMS and CHG dealt with the high cost of opening new hospitals and renovating existing ones. Provisions for VIBHA’s associates dragged down the company’s profits.

The sector’s profit is projected to dip 4% YoY in Q3, with DBMS and BH posting the biggest slip at 7% and 10% respectively. Sector sales are expected to continue growing 5%.

For 2019, the sector’s sales are projected to grow 4% YoY, although core profit is expected to dip 3%. Sales and core profit are projected to rise 7% YoY each for 2020.

Advertise

Advertise