Asia's exports receive boost from healthcare products

China produces around 40% of all APIs used worldwide.

Healthcare exports in Asia are surging given the ongoing public health crisis, providing a significant boost to Singapore's exports, but also providing some lift for Malaysia, China, and India, according to a report from HSBC.

Healthcare investment, including pharmaceutical products and biomedical equipment, has been booming as governments rush to procure protective equipment alongside a public-private sector race for a vaccine, the report noted.

“The fact that COVID-19 has exposed vulnerabilities in health systems across the globe, especially in Asia, should lead to a multi-year investment boom,” added Joseph Incalcaterra, HSBC’s chief economist for ASEAN.

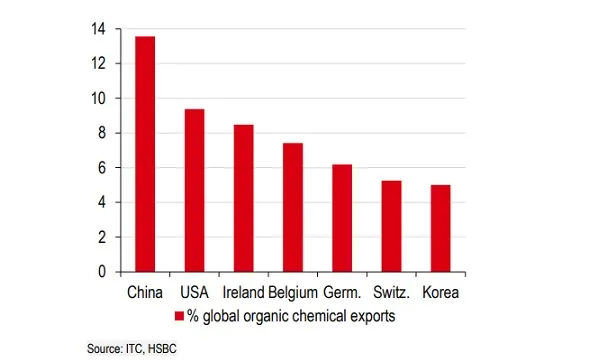

However, on the surface, pharma is much less of an Asia story, with most drugs manufactured in the West and only India ranking within top 10 amongst the biggest pharmaceutical exporters worldwide.

By share of GDP, however, Singapore has the highest share of healthcare exports, worth nearly 6% of GDP. Its NODX recently surged thanks to a 72% YoY rise in pharma shipments over the past three months. It is followed by Malaysia, the world’s largest medical glove producer, at 1.4% of GDP. China has also seen a surge in health equipment exports.

Further, Asia’s low export share of pharmaceutical exports belies that of the region, especially China’s crucial role in the production of active pharmaceutical ingredients (APIs), the main inputs during the pharmaceutical production process. The country produces around 40% of all APIs used worldwide, and India receives the largest share of China’s exports.

However, due to political concerns, the world’s reliance on imported APIs from China could lead to a trend of supply chain on-shoring. India is already accelerating plans to promote local production of intermediary drug projects, and the Pentagon considered the US’ reliance on the Chinese pharmaceutical supply chain to be a national security risk.

“Ultimately, given the fragmented and relatively low-value add nature of this production, there will be a need for forceful policy intervention and support in order to rejig supply chains here. Moreover, even significant changes in this supply chain are unlikely to influence broader export performance,” Incalcaterra noted.

Advertise

Advertise