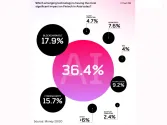

India leads healthcare private equity deals in APAC

India accounted for $4.6b of the total $14b healthcare deals in APAC.

India is seen as a "place to deploy healthcare capital at scale" as the country led the Asia Pacific's private equity deal activities in 2023, according to a report by Bain & Company.

With 22 healthcare deals in 2023, India recorded a deal value of $4.6b, slightly lower than the $4.7b in 2022, accounting for a significant share of the total announced deal in the region which reached $14b.

"Investors seeking to manage geopolitical risk began to broaden their horizons, with India representing the largest share of announced deal value and continuing to see a long-term rise in biopharma-related activity," it said.

"India’s economic growth, business-friendly government, pharmaceuticals manufacturing landscape, and thriving middle class continue to propel investment," the report read.

Global private equity deal activity reached $60b despite various factors such as global interest rates, inflation, and geopolitical uncertainties, with biopharma contributing 48% of the total value.

Per region, North America posted $29b deals across specialties such as oncology, orthopaedics, and cardiology. Bain noted that activity from providers slowed due to inflation and labour market pressures.

ALSO READ: Cybersecurity market in medical devices to rise 12.2% CAGR until 2027

Meanwhile, in Europe, announced deal value dropped to 44% year-on-year to $14 billion in 2023 due to constrained creditations, disrupted labour and inflation led to dampened activity from providers. Some processes also did not close transactions.

“Despite the slower start to 2023, we see green shoots in the buyout market," Nirad Jain, co-lead of healthcare private equity at Bain & Company, said.

"In 2024, sponsors will need to establish higher confidence in value creation opportunities earlier and think beyond pure commercial diligence. Successful investors will evaluate a wider set of factors early in their process to create value quickly,” he added.

Advertise

Advertise