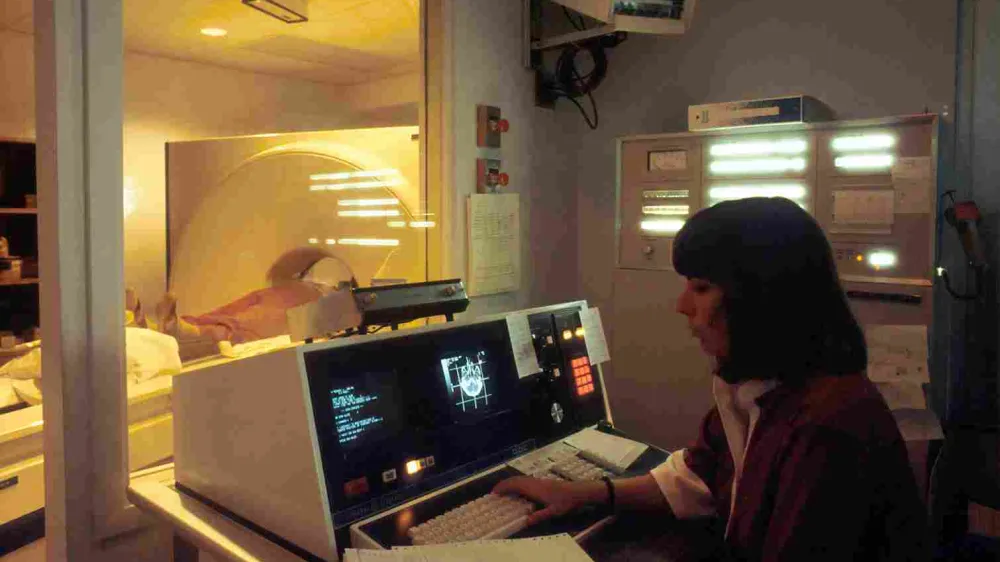

AI, cloud to drive $10.2b medical imaging market shift by 2033

AI-enabled imaging workflows cut turnaround times, improve efficiency.

The global medical image management market is poised to surge to $10.2b by 2033, with a compound annual growth rate of 9.8%, driven by the integration of artificial intelligence (AI) and the digital transformation of healthcare, according to Verified Market Reports.

Asia-Pacific is the fastest-growing region, driven by rising chronic disease prevalence, expanding diagnostic capacity, and government-led hospital digitisation programmes.

China and India are generating exponential growth in imaging volumes, whilst Japan, South Korea, and Australia are early adopters of AI-enhanced imaging workflows, the report said.

Investment in smart hospitals and national health information exchanges is also accelerating market expansion and attracting global vendors.

North America and Europe dominate the market due to their high technology adoption, established regulatory standards, and strong public healthcare systems, with emphasis on cross-border health data exchange.

Latin America, the Middle East, and Africa represent emerging opportunities, with improving healthcare infrastructure and growing private-sector participation despite budget constraints and uneven digital maturity.

Healthcare providers are rapidly moving from fragmented Picture Archiving and Communication Systems and departmental viewers to unified enterprise imaging platforms, reducing data silos and supporting longitudinal patient records across radiology, cardiology, pathology, and dermatology.

Embedded AI tools now automate image routing, prioritisation, quality checks, and preliminary findings, significantly reducing turnaround times and creating opportunities for solution providers without disrupting existing clinical workflows, the report said.

Cloud-based and hybrid image management models are also expanding due to scalability, cost predictability, and remote access advantages, with hospitals adopting hybrid strategies to balance data sovereignty, latency requirements, and disaster recovery whilst gradually modernising legacy infrastructure.

Evolving privacy, cybersecurity, and interoperability regulations are reshaping procurement decisions, with vendors now offering advanced encryption, audit trails, and compliance-ready architectures.

Non-radiology imaging volumes are growing faster than traditional imaging, with surgical imaging, ophthalmology, pathology digitisation, and point-of-care ultrasound driving new application developments and revenue streams for image management platforms.

Despite strong growth fundamentals, high implementation costs, integration complexity with legacy systems, and clinician resistance to workflow changes pose challenges.

Data security concerns and compliance requirements further slow decision-making, whilst smaller healthcare facilities often struggle to justify upfront investments without clear short-term returns, the report said.

However, application-specific use cases are helping mitigate these challenges by delivering measurable value, whilst modular deployment models and subscription-based pricing are also lowering entry barriers.

The market presents a blend of defensive stability and innovation-driven upside, as demand is anchored in non-discretionary diagnostic services, whilst growth is fuelled by AI, cloud transformation, and expanding clinical applications, according to the report.

Advertise

Advertise