Healthcare Singapore REITs post 5% gain, firm on expansion

Quality healthcare and senior care services gather steam in key markets like Japan and Singapore.

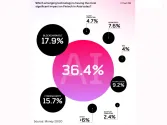

The two healthcare-focused real estate investment trusts (REITs) listed on the Singapore bourse bounced back from last year’s slump with a 5% average total returns in the first seven months of the year.

A recent market update by the Singapore Exchange Research showed ParkwayLife REIT posted a 5% gain as of end-July from its 25% plunge last year, while First REIT recorded 4.9% in returns to partially reverse the 6.4% decline last year.

The two REITs, which have a combined S$3.35b (US$2.47b) in assets under management (AUM), booked net institutional outflows of S$19m (US$14m), and posted S$16m (US$11.8m) in net retail inflows for the first seven months of the year.

PLife REIT, whose S$2.2b AUM is concentrated in Singapore and Japan, saw its distribution per unit (DPU) inch up by 3.3% year on year to 7.29 Singapore cents in the first half thanks to the 24% surge in gross revenue, driven by strong contributions from its two core markets.

The trust sponsored by Singapore-based healthcare provider, Parkway Holdings, is betting on the rapidly ageing population and rising demand for quality medical and aged care services as it plots its growth strategy towards a third key market, according to SGX Research.

First REIT, meanwhile, posted a 6% dip in DPU at 1.24 Singapore cents for the first half, after higher financing costs, a one-off increase in unit base and foreign exchange risks more than offset the 0.4% increase in its rental and other income.

Building on the newly acquired 14 nursing homes in Japan last year, the S$1.15b REIT vowed that it will continue to grow its portfolio and make developed markets account for more than half of its AUM by 2027.

Advertise

Advertise