How can Southeast Asia increase its medical tourism pie?

A US patient can save as much as 80% in Malaysia, 75% in Thailand, and 40% in Singapore.

Jetsetters seeking life-altering medical procedures are increasingly eyeing Southeast Asia as a medical tourism destination, given the potential cost savings and access to cutting-edge treatments, while avoiding long wait times back home.

The region is on track to solidify its position as a key medical tourism player, with more hospitals and clinics that are home to renowned doctors and specialists investing more heavily in high-tech medical devices, according to an RHB Investment Bank Bhd report in August.

Major healthcare providers, including Bangkok Dusit Medical Services, IHH Healthcare, and KPJ Healthcare are banking on rising demand in the region, which captures a third of the world’s tourists seeking affordable and high-quality treatments, it said.

“Beyond value-for-money service offerings, the rise of qualified professionals, in our view, will continue to drive the medical tourism industry in Southeast Asia,” RHB said. “This, in turn, should benefit prominent healthcare service providers in the region.”

The global medical tourism market was valued at $13.1b in 2023, according to Market.us. It is expected to be worth $35.9b by 2032, or a compound annual growth rate of 12.2%. Medical tourism can save patients as much as 70% of the cost of care compared with the US.

RHB said Malaysia and Thailand are the biggest winners. Thailand leads the region in revenue at $850m. Malaysia’s medical tourism revenue was $ 444m, while Singapore’s was estimated at $270m.

“As the strong SGD made Singapore a less attractive medical tourism destination, we see Thailand and Malaysia benefiting from the shifting of interest from medical tourists seeking value-for-money quality healthcare services; they will also benefit from visa-free travel to both countries,” it added.

Thailand recently signed a deal with Saudi Arabia to attract medical tourists, and relaxed medical visa regulations last year to make healthcare more accessible to international patients. Malaysia’s advantage, meanwhile lies in specialisations such as in-vitro fertilisation, with the highest success rate achieved by Alpha IVF Group, a fertility care provider in Selangor.

Malaysia has also signed a deal with China, extending visa-free travel until end-2025. “Such a policy is expected to have a positive spillover effect on medical tourism, as China tourists account for 5% of the country’s medical tourism revenue,” RHB said.

RHB said a medical tourist’s main consideration has always been centred on the cost of treatment. “On the back of stubbornly high inflation and long waiting times at hospitals in developed countries — in the US and UK, the waiting time for treatment could reach as long as 52 weeks — medical tourists are seeking cross-border healthcare alternatives to fulfil their needs,” it added.

For example, a patient from the US could save as much as 80% in Malaysia, 75% in Thailand, and 40% in Singapore, depending on the type of treatment itself, RHB said. In Thailand, which is known for plastic and reconstructive surgery services, the average cost of a facelift is $2,400 versus $19,000 for a similar procedure done in the US.

Trust and confidence

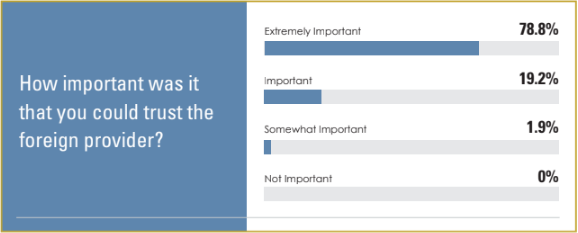

A report by the Medical Tourism Association this year showed that trust influences 97% of patient decisions to pursue healthcare overseas. About 63% of patients said they would choose a healthcare provider with an international accreditation.

“This underscores the profound impact accreditation has on reinforcing patient trust and confidence,” it said.

Trust and accreditation remain a challenge for Indonesia’s less established medical tourism industry, given its lack of brand recognition and healthcare infrastructure, RHB said. The country loses billions of dollars in revenue as many of its citizens seek medical treatment abroad, it added.

To stem the outflow, the government is developing a 41-hectare medical tourism special economic zone in Sanur, Bali and has allowed foreign doctors to practise in Indonesia. There is also a proposal to streamline the employment process for foreign doctors and Indonesian graduates from foreign institutions.

Meanwhile, the Medical Tourism Association report noted that whilst quality and trust dominate patient decisions, 28.8% of the respondents said they are also influenced by cost. It said 34.6% of patients worried about hidden costs, whilst 26.9% feared international payment scams.

“Transparent, comprehensive, and competitive pricing is crucial to converting inquiries into active medical journeys, and the cost of the entire medical trip is a major consideration,” according to the report.

Questions to ponder:

- How can Southeast Asian hospitals meet international accreditation standards?

- How can healthcare providers ease concerns about hidden costs?

Advertise

Advertise