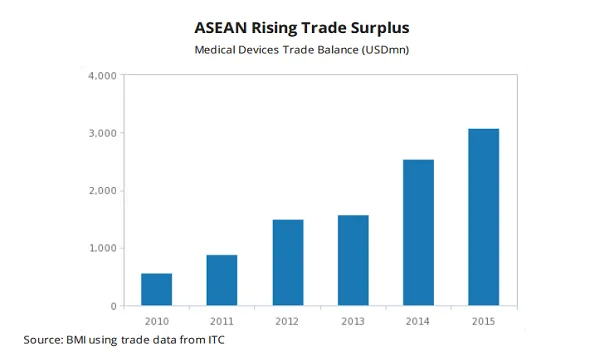

Chart of the Week: Check out how ASEAN medical devices is facing a surplus bubble

Trade liberalisation is causing supply to skyrocket, analysts say.

Looser trade has cemented the Southeast Asian region’s reputation as a medical device distribution centre, amassing a trade surplus reaching USD3.1b the previous year.

According to a report by BMI Research, surpluses for Singapore, Malaysia, Philippines and Vietnam however, were offset by deficits for other ASEAN members, notably Indonesia.

“We note that the trade surpluses for Malaysia and Singapore have grown at a 2010-2015 CAGR of more than 20%. This reflects growing distribution and manufacturing activity by medical device multinationals,” the report noted.

In Singapore, BMI Research said the government has been active in promoting the local manufacturing industry establishing the Centre for Biomedical Material Applications & Technology (BIOMAT) as early as 1995.

“Government incentives to attract companies to locate their manufacturing operations in Singapore include a tax-relief period when companies start up, a low rate of corporation tax, R&D and manufacturing grants and grants for training staff at new manufacturing sites,” BMI Research added.

The Malaysian Investment Development Authority (MIDA) is also promoting areas such as electrodiagnostic equipment, cardiovascular devices and orthopaedics.

“Meanwhile the trade balance for the Philippines and Vietnam has moved from deficit to surplus due to manufacturing activities within the consumables product area, notably syringes and needles for the Philippines, and catheters & cannulae for Vietnam. Multinationals with manufacturing operations include B. Braun and Terumo,” the report added.

Advertise

Advertise