Singapore

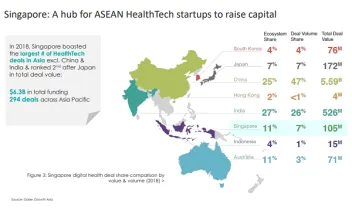

Singapore clinched $145.78m of healthtech deals in 2018

Singapore clinched $145.78m of healthtech deals in 2018

The city trails only behind China and India in terms of deal value.

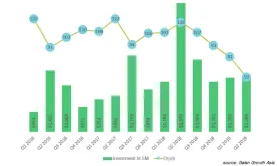

Asian healthtech deals hit $2.5b

$595m went to firms geared towards health management solutions.

The chatbot will see you now – virtual HCP engagement in the Asia Pacific

There is little doubt that the Asia Pacific region represents a key growth ambition for the majority of Life Sciences companies. Statistics around unmet healthcare needs are well-known and, as the saying “necessity is the mother of innovation” goes to show, the Asia Pacific has an opportunity to leapfrog the West when it comes to novel therapies and approaches to market access. But at the same time, cost control and compliance remain sizeable challenges.

IT budgets could shrink for half of life sciences firms

Only 15% of life sciences firms believe digital tools could enhance customer experience.

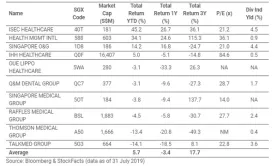

Top three healthcare firms in Singapore averaged total return at 31.2% in January-July 2019

These three firms’ average dividend yield came at 3.3% over the same period.

Genesis Healthcare launches wellness app

Users can receive lifestyle tips and health recommendations based on individual DNA.

Temasek unit invests $5m in HC Surgical Specialists

It will be done through a 3-year 5.5% convertible bond at a conversion price of $0.54 per share.

Raffles Medical Group profits down 14.7% in H1

Operating revenue fell due to the promotion and building costs for its Chongqing hospital.

Temasek unit invests $5m in HC Surgical Specialists

It will be done through a 3-year 5.5% convertible bond at a conversion price of $0.54 per share.

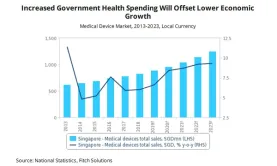

Singapore's medical device market value to hit $1.3b by 2023: analyst

Increased government expenditure will support the segment.

Is it time to invest in at-home technologies for chronic disease care in Singapore?

Two in five health practitioners recommend a more integrated hospital-home care approach.

Mount Alvernia Hospital and Icon SOC partner to launch $25m integrated cancer centre

The upcoming facility is expected to start its operations in late 2020.

Medical device revenues to dip in 2020 as R&D expenses rise

The push for domestic production will divert more funds into research and development to cushion against trade tensions.

Medical device FDIs to extend slump in 2020

India’s foreign investments into the sector crashed 60% in 2017 and 2018 down to $67m.

Biolidics calls for trade halt pending reimbursements for cancer tests

The fees related to the tests will be reimbursed by China’s National Healthcare Security Administration under its national basic medical insurance programme.

Over $1b worth of MediSave top-ups and GST vouchers await 1.7 million Singaporeans

The benefits will be received from July to November.

Novena Global Lifecare to set up $150m Sino-Singapore healthcare fund

It will invest in medical services, biomedical projects, mature drugs and precision medicine companies.

Advertise

Advertise