Radiopharma market to hit $21.8b by 2033 on cancer therapy boom

The Asia-Pacific region is projected to have the highest growth rate.

The global radiopharmaceuticals market is projected to reach $21.8b by 2033, registering a compound annual growth rate of 10.6%, driven by the prevalence of chronic diseases and increased research and development activity, according to Allied Market Research.

The Asia-Pacific region is expected to record the highest growth rate during the forecast period, supported by expanding healthcare infrastructure and rising investment in hospitals, diagnostic centres, and research facilities.

Growing incidence of chronic conditions—including cancer and cardiovascular disorders—is also contributing to regional demand.

North America held the largest market share in 2023, accounting for more than 40% of the industry, and is expected to maintain this position through 2033.

The report notes that this dominance is supported by pharmaceutical infrastructure and regulatory frameworks governing reimbursement and research.

By application, cancer treatments accounted for 52.2% of market revenue in 2023, remaining the largest segment due to the adoption of personalised medicine and molecular profiling.

Within the radioisotope category, Technetium 99m remains the dominant isotope because of its physical properties and compatibility with drug formulations.

Growth constraints include the high costs associated with development and implementation, as well as potential side effects, whilst pipeline products under development present future opportunities for the sector.

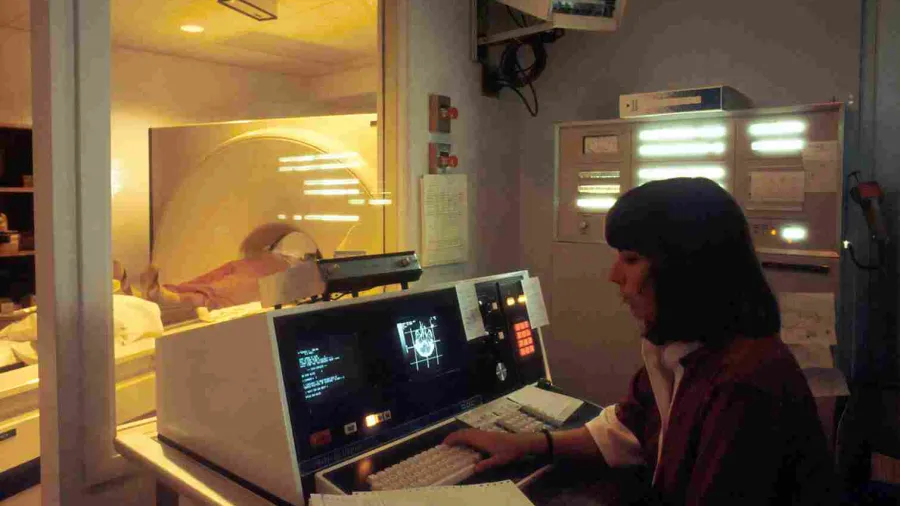

Hospitals and clinics are the primary end users and are expected to maintain the highest growth rate amongst user segments. The report also cited key market participants.

By product category, diagnostic radiopharmaceuticals hold the majority share, whilst the therapeutic segment is expanding through targeted radionuclide therapies for prostate cancer and neuroendocrine tumours.

Regulatory policies from oversight agencies affect market entry timelines and regional competitiveness, whilst reimbursement frameworks influence adoption in clinical settings.

Advertise

Advertise