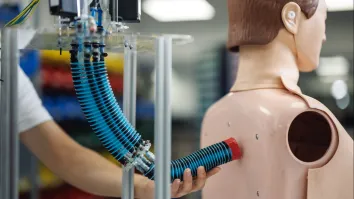

Thailand boosts medical robotics investment through targeted incentives

The maximum corporate income tax exemption may vary based on medical robotics' targeted activity.

Thailand’s Board of Investments (BOI) has rolled out several investment promotion incentives in its bid to promote medical robotics across the country’s healthcare sector.

These incentives vary because medical robotics is related to three targeted activities– manufacture of automation machinery/equipment with engineering design, assembling of robots or automation equipment/parts, and manufacture of high-risk or high-technology medical devices.

For instance, the maximum corporate income tax (CIT) exemption is 8 years for both manufacture of automation machinery/equipment with engineering design, and the manufacture of high-risk or high-technology medical devices. However, the CIT exemption for the assembling of robots or automation equipment/parts is 5 years

Many public and private organisations have also been working closely together to drive medical innovation by promoting medical robotics. The Ministry of Science and Technology, Ministry of Public Health and Ministry of Education have jointly set up a committee whose key responsibility is to promote medical and health-related innovations.

BOI added that the country plans to leverage on its reputation and excellence in medical services and medical devices and strengthen its position as the regional medical hub.

“The nation is making good progress in the development and use of robotics in the field of medicine and promoting investment in robotics technology, including medical robots,” the BOI said in a statement.

Advertise

Advertise