Bigger healthcare spending in the cards for China

The country saw overwhelmed hospitals and disrupted routine services amidst the pandemic.

China could likely push higher healthcare spending following the COVID-19 pandemic, to address areas of improvement and build a better healthcare system, according to a report by Morgan Stanley.

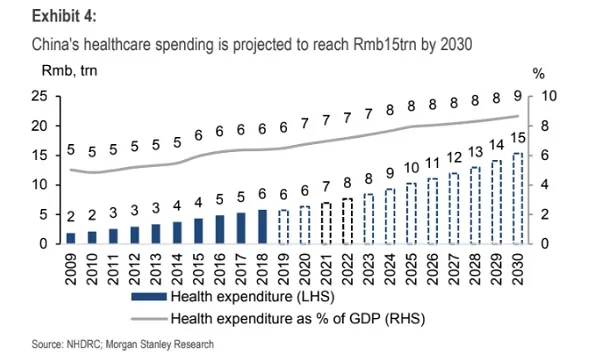

China’s healthcare spending has not been a key issue in the past. It rose only moderately from 5% of GDP in 2009 to 6.6% of GDP in 2018, albeit an extended coverage from 1.23 billion to 1.35 billion people.

“However, amid slowing GDP growth, changing demographics and rising expectation for further reduction of out-of-pocket spending (to 25% by 2030), healthcare financing could face more problems going forward, likely to require a further increase in the individual premium rate or more fiscal support from the government,” the report noted.

Further, the SARS pandemic in 2003 pushed China to make healthcare system changes, and now China is halfway through its reforms and appears largely on track to build a true universal healthcare system by 2030.

Significant progress has been made with this, such as establishing a basic social insurance regime covering over 95% of its population, but significant issues still exist. Insurance coverage on critical illness is still not enough for most people, and the government still had to aid all Covid-19 patients this time around.

“Insufficient primary care infrastructure resulted in overwhelmed hospitals and disrupted routine services during the virus outbreak; public health infrastructures still require substantial upgrades to help stem communicable and non-communicable diseases,” the report added.

China’s healthcare system is still expected to continue to be serviced mainly by the public sector because of its immense size, but there is plenty of room for private insurers, healthcare providers, and producers to continue to develop.

Further, the looming funding pressure that stems from the country's ageing population may also foster a need for more private sector input, in the form of public-private-partnerships, especially in developing segments such as health surveillance, information tracking, and preventive care.

Reforms in the past decade have affected almost every aspect of the healthcare system, including social insurance, primary care, hospital management, medication and public health. The system has progressed with improving health outcomes, but issues still remain in terms of attainability, affordability and sustainability, Morgan Stanley noted.

Advertise

Advertise