Rapidly growing costs stunt Thailand's healthcare goals

Epidemiological changes, healthcare spending, and lack of integration persist.

With almost half of its electorate above 50 years old by 2025, Thailand is fast becoming one of the countries with the oldest populations in the region. Next only to Singapore in terms of its ageing electorate, the country is also a highly attractive retirement spot for foreigners who prioritise affordable and quality healthcare and like the tropical weather.

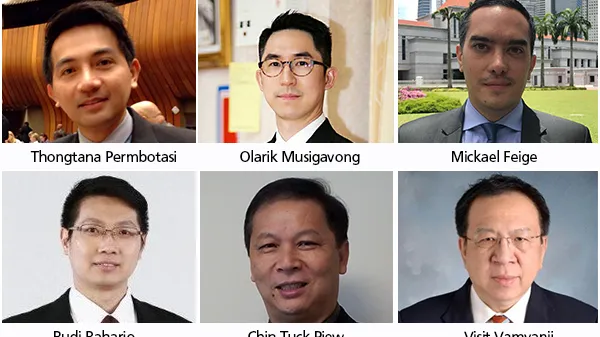

Mikael Feige, partner, Solidiance, said that healthcare demand is expected to accelerate given Thailand’s demographic transition. According to him, growth rates of seniors in Thailand are predicted to be much higher than OECD and will surpass the growth rates of the working population aged 16-24. The government has been fast at work trying to address this on top of other healthcare concerns, resulting in the growth in health spending per person which has outpaced growth of GDP per capita in Thailand since 2014.

However, Feige said that Thailand’s spending for healthcare remains flat and not proportional to the rising healthcare demand. He showed that before 2017, Thailand’s share of healthcare spending over the total government expenditure remained flat. While there was a 1% increase in 2017, it might not be enough to prepare for the rising demand for and costs of healthcare.

“The rise of healthcare needs in Tier 2 and Tier 3 cities not only in Thailand, but in other countries in Southeast Asia, has led us to ask, how do we set up hospitals? Because Tier 1 cities are already mature, Bangkok already is, and the wealth of populations in Tier 2 cities is rising overtime, and more and more private care is becoming available,” Feige said.

Amongst ASEAN 6 (Malaysia, Singapore, the Philippines, Indonesia, Thailand, and Vietnam), Thailand ranks second in terms of public healthcare expenditure. The country currently allocates 3.2% of its entire budget to health, compared to 2.3% for Malaysia, 2.1% for Singapore, 1.6% for the Philippines, 1.1% for Indonesia, and 3.8% for Vietnam. This may seem like a welcome development, but it falls short when juxtaposed with the average public healthcare expenditure all over the world at 5.9% and the average public healthcare expenditure of OECD countries at 7.69%.

Pain points

Thongtana Permbotasi, deputy director, Division of National Strategy and Reform, Ministry of Public Health, said that Thailand’s healthcare challenges can be summarised into three categories: epidemiological changes, high healthcare spending, and the lack of highly-integrated care.

Changes in Thailand’s epidemiological landscape include aged patients with unexpected treatment outcomes, the increasing need to address migrants’ health, and the emergence of infectious diseases such as tuberculosis. On top of these changes, Thailand needs to find solutions to high healthcare spending characterised by increased BOR and LOS, unnecessary re-admissions, high cost of interventions, inappropriate drug use, and low quality management. The country is also challenged by primary healthcare inefficiency and poor networking and community engagement.

Healthcare costs in Thailand are also exacerbated by other factors from both the demand and supply sides. Visit Vamvanij, director, Siriraj Hospital, said that rising healthcare costs are caused by behavioural changes in the population such as high expectations of patients and greater health concerns. On the supply side, Vamvanji noted the costs of ineffectiveness and inefficiency as well as the lack of data and insight into cost and saving opportunities.

According to Feige, Thailand has indeed an opportunity to become a leader in cost efficiency and could achieve better outcomes with higher spending as compared to high-income nations. He cautioned that outcomes delivered from healthcare systems are certainly not directly proportional to the health expenditure spent, and Thailand might face the challenge of diminishing returns due to increase in health spending.

“Gradual improvement in Thailand health is comparable to neighboring countries like Malaysia and Singapore. Despite the rising challenges, Thailand could take early actions to strive the right balance for health spending. Thailand could take early actions in ensuring the resources spent on healthcare are optimised and move towards or maintain on the efficient frontier by focusing on the 3 key actions recommended: generate new source of healthcare funding; streamline processes and budget to reduce overhead cost; and invest more in prevention at early stages of treatment,” Feige added.

In terms of improving access to healthcare across the country, Feige said that Thailand could introduce streamlined public co-payment schemes instead of loosely covering free health services. At present, Thailand has established comprehensive co-payment schemes, trying to offer healthcare for all citizens, often through a general social health coverage, instead of savings and co-payments.

“Improving the taxation of unhealthy goods could improve revenues and set better incentives for consumers. Government could channel resources obtained from excise tax on unhealthy consumption to. providing healthcare services. Harmonisation across countries is needed to avoid parallel imports,” Feige said.

Regional healthcare hub

Amidst challenges that the government faces when it comes to providing affordable and quality healthcare, Thailand continues to thrive as a medical tourism hub in Southeast Asia. The competition is heating up, as neighbouring countries begin to strategise and offer less costly healthcare to foreigners. For instance, the Philippines is planning to build a large hospital with a specific focus on medical tourism, on the back of a rising expat population.

“We’ve seen 3 million people come to Thailand for medical treatment over the past year. That’s much more than Malaysia and Singapore. We’ll keep growing but to what extent, I am not sure. I think the Chinese are still the ones that can grow the market when they come to Thailand. Hospitals here have the experience and knowledge for these kinds of patients, and the prospect for three to four years remains good,” Feige said.

In 2017, it was estimated that Thailand will receive almost THB50b in income from international patients, a 3%-4% growth from the previous year. The International Healthcare Research Centre (IHRC) reported that medical tourism in the country will likely grow by 14% annually alongside the 12% growth of international tourist arrivals in the country.

The Thai government has identified 19 countries as potential sources of medical tourists, and has approved a visa extension scheme for tourists from Cambodia, Myanmar, Laos, Vietnam, and China. For the other 14 countries, the government is also extending 10-year visas, a move to encourage more medical tourists and further grow Thailand as a healthcare centre.

Olarik Musigavong, assistant hospital director, Chaophya Abhaibhubejhr Hospital, said that compared to Singapore, India, Malaysia, and South Korea, Thailand has a clear competitive advantage when it comes to the aspects of service and hospitality, the level of technological innovation, the quality of human resource management, the strength of partnerships, accessibility to the market, and the affordability of healthcare.

One of the recent medical tourism milestones in Thailand is a partnership between popular mobile application BookDoc and Bumrungrad Hospital, one of the largest private hospitals in Southeast Asia. BookDoc allows users to connect to the best medical professionals in the region, and the network of the application continues to expand across top medical destinations.

Musigavong said that going forward, the medical tourism in Thailand should continue to work on a national policy, streamline organisational inefficiencies, embark on public-private partnerships, strengthen its wellness tourism strategy, improve human resource development, and work towards more hospital accreditations. At present, Thailand has 56 Joint Commission International (JCI) accreditations, more than double that of Singapore and thrice as much as Malaysia’s.

Thailand’s healthcare sector must take into account the various components of the Global Wellness Economy, and focus on the rapidly growing components that it can deliver on, such as beauty and ageing; wellness tourism; healthy eating, nutrition, and weight loss; fitness of mind and body; and preventive and personalised medicine and public health, amongst others.

According to Musigavong, healthcare leaders can also take their cue from medical tourism countries across the world. In Asia, India, Malaysia, Singapore, and South Korea remain tough competitors as well as good examples of medical tourism. Latin America has Brazil, Costa Rica, Mexico, and Cuba. Meanwhile, the Middle East has the United Arab Emirates (UAE) and Europe has Hungary, Poland, and Turkey.

Meanwhile, Budi Raharjo Legowo, managing director of finance and accounting at PT Siloam International Hospitals based in Indonesia, said that medical tourism remains a goal for Indonesia. The country’s healthcare sector at present mainly caters only medical support for tourists who wish to take some tests or who need to go through very basic procedures while on vacation.

In search of a cure

In its drive to improve healthcare, Thailand has four reform aspects: effective governance and administration, policy integration and decentralisation, human resource transformation, and IT and digitalisation. Permbotasi said that in terms of strengthening service delivery, the government has also prioritised the enhancement of primary care and value-added to Thai traditional medicine, and disease prevention and health promotion, amongst others.

Additionally, Feige said that although painful, the government may want to consider streamlining personnel costs to improve cost efficiency. Across, ASEAN 6 share of emolument costs of the total budget varies depending on each country’s practices. For countries with a higher spending on emolument, they should strive to minimise wastage and reduce redundancy by streamlining administrative processes.

“On top of increasing funding, the local governments could also improve its efficiency in utilising the resources allocated to healthcare to minimise wastage and reduce redundancy. For example, as suggested by OECD, one of the wastage faced by its members is on administrative processes that add no value and money lost to fraud and corruption. This should also be an area for the local government of Thailand to further enhance its practices,” Feige said.

Chin Tuck Piew, administrator, Gleneagles Kuala Lumpur, said that the region’s hospitals must be able to quantify their turnover costs. Specifically, administrators have to consider two types of costs: direct and indirect. According to Chin, direct costs include job ads, recruiting fees, signing bonuses, and salary increases. Meanwhile, indirect costs may be loss of productivity and loss in training when an employee who resigns takes away the skills and knowledge acquired at the expense of the hospital. These factors affect other employees who are also likely to resign.

Furthemore, Chin said that there are internal and external challenges, and that administrators should continually ask themselves certain questions: who is going to do the work? What knowledge are we about to lose? What skills will we lose? What traditions will change? Hospital leadership must understand that the marketplace for good talent is competitive and that good people will be able to pick and choose their working environment. They must also consistently ask themselves how to create an organisation where people want to stick around.

“Many times when a staff does not come to work or take plenty of sick leaves, a lot of managers send them to the HR. You do not even actually find out the issues, and you think that HR is the department that can solve your problems, which today is impossible. You know your people better, you should be accountable for them,” Chin said.

If the region’s hospitals wish to capture the better part of the talent pool, Chin proposed a transition from the old way of hiring people to newer, more effective strategies. According to him, the old way concentrates all people management responsibility to the HR, highlights good pay and benefits, likens recruitment to purchasing, assigns development to training programs, and treats everyone the same way.

New strategies on attrition and retention management place the accountability of strengthening talent pools to all managers; shapes workplace, jobs, and strategy to appeal to talented people; likens recruitment to marketing; fuels development through stretch jobs, mentoring, and coaching; and affirms its people, but invests differently in A, B, and C players.

“The traditional way of hiring people, going to the website portal, is not good enough. Recruitment should be strategic and we should determine how we are going to get people outside to add value to the organisation. We do a lot of recruitment through networking and not so much going to the network portal. We network with a lot of the talent of other hospitals because they know their talent, they know well what they can and cannot do,” Chin added.

According to Vamvanij, hospitals can achieve greater efficiency through the application of lean thinking, or the endless transformation of waste into value from the customer’s point of view. Vamvanji cautioned that lean thinking is not the same as cost reduction. Lean thinking focuses on preventing overproduction and thus, reduces wastage. “The first step is care and process redesign. Next, with the help of automation, we can have a better way of working things out through IT and robotic innovation. Then, we have to do job redesign through upskilling, substitutions and expansion,” he said.

Ways forward

Permbotasi said that the government recognises its incapability to tackle future challenges, even after conquering present threats to the public healthcare system. Currently, the government continues to require high technology service and reform that provides more space for participation and collaboration from individual to macro levels. He also said that research and development should have an entrepreneurial component.

Legowo said that hospitals can benefit from establishing a visual financial dashboard and setting clear goals for their hospital. For instance, PT Siloam International Hospitals’ dashboard presents the group’s aim to achieve the a 10,000 bed count and 50 hospitals in 34 cities and 22 provinces by 2019, as compared to the 6,800 bed count and 33 hospitals in 24 cities and 16 provinces they have in 2018.

Part of the work that PT Siloam International Hospitals does to achieve its goals is to go on acquisitions after it went public in 2013. In 2017, the company acquired the 105-bed Putera Bahagia General Hospital (RSUPB) in Cirebon for a price of Rp 130b or USD 9.7m. According to Legowo, one of the major challenges of expansion is looking for manpower to fill roles that the head office can no longer fulfill.

At present, Legowo said that their financial dashboard is continually e-mailed to the management for their comments, but with the help of data analytics and artificial intelligence, future financial dashboards could be more interactive and efficient, so that goals and initiatives are more actively monitored and updated alongside the company’s fulfillment of its day-to-day needs.

Legowo said that a financial dashboard must be able to measure results and the given parameters, must be accessible anytime, must align with business performance, and must be available when needed for decision making. Permbotasi agreed that the government has to explore strategies to make sustainability sustainable amidst the growth of healthcare costs, with the private healthcare sector’s share rapidly growing as well.

When it comes to which disabilities should take the bigger piece of the pie, Feige emphasised the need to prioritise drivers of disabilities in Thailand, such as osteoarthritis, COPD or pulmonary disease, and diabetes. Prevention is still the most important way to address dreaded diseases and yet ASEAN’s resources dedicated to prevention is negligible. Feige said that there should be a shift of focus in the continuum, from late to early stages of disease, to achieve a disability-free increase in life expectancy.

In addition, Vamvanij said that the healthcare sector must take a close look at antimicrobial resistance (AMR) as it is an increasingly serious threat to global public health. He said that the cost of health care for patients with resistant infections is higher than care for patients with non-resistant infections due to longer duration of illness, additional tests and use of more expensive drugs. The success of cancer treatments and major surgeries would not be enough without effective antibiotics.

Chin placed emphasis on the importance of keeping medical staff fulfilled and happy, because after all, the success of the healthcare sector depends highly on those who deliver the services. “It’s really important for us to keep our employees. From my analysis in Gleneagles, salary was actually number three in terms of keeping employees happy. Number one was actually work environment. They do not like their managers, they do not seem to know how to take care of their employees. And I do not blame the managers, I blame the model of the organisation,” Chin said.

Finally, to keep up with the evolving digital landscape, Thailand’s healthcare sector must work closely with the health tech startup ecosystem. To date, there are almost 40 health tech startups in the country, with a USD10.5m investment across areas such as service search, telehealth, clinic or pharmacy management systems, personal health and fitness, remote monitoring, and communication aid, amongst others.

Advertise

Advertise